2024 Tax Married Jointly Filing Jointly

2024 Tax Married Jointly Filing Jointly. Most couples save money by filing jointly. It can lower your taxable income, reduce your tax.

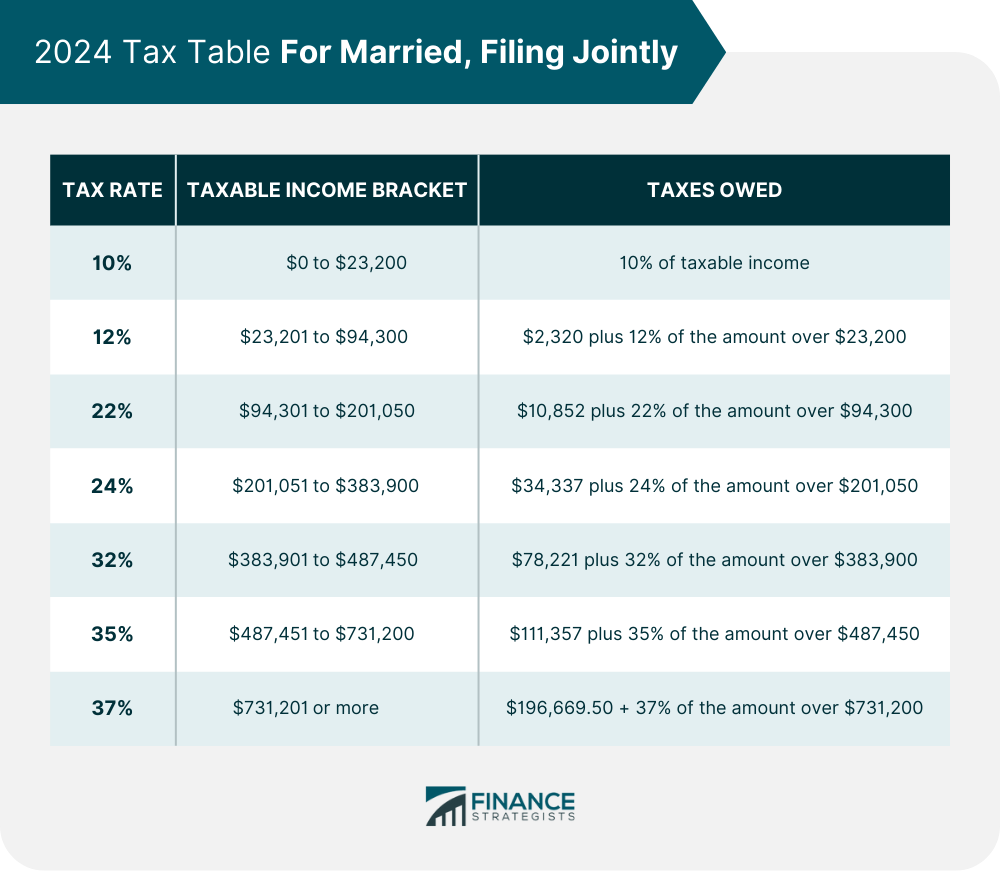

The “married filing jointly” tax brackets apply specific tax rates to combined incomes. Here’s how that works for a single person with taxable income of $58,000 per year:

2024 Tax Married Jointly Filing Jointly Images References :

Source: catybmallissa.pages.dev

Source: catybmallissa.pages.dev

2024 Tax Married Jointly Filing Separately Jessi Lucille, Married couples filing jointly will see a deduction of $29,200, a boost of $1,500 from 2023, while heads of household will see a jump to $21,900 for heads of household, an increase of $1,100.

Source: reneymeggie.pages.dev

Source: reneymeggie.pages.dev

2024 Tax Tables Married Filing Jointly Single Sande Cordelia, Find the current tax rates for other filing statuses.

Source: charleanwgerry.pages.dev

Source: charleanwgerry.pages.dev

2024 Married Filing Jointly Tax Brackets Golda Gloriane, The alternative minimum tax exemption amount for tax year 2024 is $85,700 and begins to phase out at $609,350 ($133,300 for married couples filing jointly for whom the.

Source: janaqmarcellina.pages.dev

Source: janaqmarcellina.pages.dev

Tax Bracket 2024 Married Filing Separately With Dependents Cris Michal, Are you married and unsure whether to file your taxes as ‘married filing jointly’ or ‘married filing separately’?

Source: megenbkissee.pages.dev

Source: megenbkissee.pages.dev

Tax Brackets 2024 Married Filing Jointly Married Jointly Phaedra, This guide explains the key differences and helps you decide which.

Source: rhetabjeanelle.pages.dev

Source: rhetabjeanelle.pages.dev

2024 Irmaa Brackets Married Filing Jointly With Spouse Malia Rozalie, The additional standard deduction amount for 2024 (returns usually filed in early 2025) is.

Source: sallybandriana.pages.dev

Source: sallybandriana.pages.dev

Us Tax Brackets 2024 Married Filing Jointly Emlyn Iolande, These amounts are up from.

Source: megenbkissee.pages.dev

Source: megenbkissee.pages.dev

Tax Brackets 2024 Married Filing Jointly Married Jointly Phaedra, Most couples save money by filing jointly.

Source: trudabmirabelle.pages.dev

Source: trudabmirabelle.pages.dev

Tax Brackets 2024 Married Jointly Reggi Charisse, See current federal tax brackets and rates based on your income and.

Source: lottiychristian.pages.dev

Source: lottiychristian.pages.dev

2024 Tax Brackets Married Filing Jointly Irs Laney Carmela, Therefore, if you are married by december 31st, 2024, you may file a joint tax return with your spouse for the 2024 tax year.

Category: 2024